On-going support for our recommendations towards Brisbane and SEQ Property markets

We have been guiding people towards the Brisbane and SEQ residential property market for the last 2 years. Long before anyone else in the southern states was considering it as an option, particularly as Sydney enjoyed skyrocketing property prices (which meant no “value” for investors and yields that didn’t make commercial sense for an investor to consider).

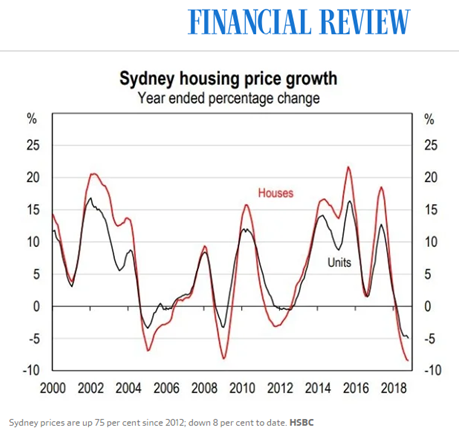

But as we always tell our clients, what follows a big surge is often a big drop. People will refer to this as “property values dropping in Sydney and Melbourne” but we would argue that the figures that the Sydney (and to a lesser extent) Melbourne experienced up until recently (last 6 -8 months) left the market in an artificially high state of uncertainty.

Residential property prices in Sydney 6 – 8 months ago were at an artificial level, and were always going to drop when the “correction”occurred. Prices in Sydney and Melbourne are now dropping to what would be considered “reasonable” levels (according to HSBC Sydney has dropped 8% and Melbourne 5%) yet there is more to come, and we believe some areas in these markets will come down a further 10% – 15%. HSBC agrees with us and believe a drop in the range of 12% – 16% will be seen.

People will say “property values have plummeted” but we would argue that they are simply making their way back to true market value, and the levels we see them move to will be reflective of a normal market in stable conditions.

Below is a graph indicating percentage change across Houses and units. We recommend property which is most relevant and appropriate to our client’s individual criteria and so we recommend all styles and types of property (houses, townhouses, and Units). This is the only way you can offer truly unbiased advice.

You will notice that units never saw the peaks that houses did, but they also didn’t see the troughs and so we believe the apartment market represents a more stable and predictable class of property.

However this statement comes with a caveat…..

The apartment must be in a quality project, well located and be strong across P.I.E Fundamentals (Population, Infrastructure and Employment). If you buy an apartment in an inferior project that doesn’t satisfy “investment grade” you will put yourself in jeopardy. So care must always be taken and you should consult an industry expert to guide you through the process of identifying, and then acquiring a premium property.

All housing estates or townhouse projects we recommend to our clients must have maintenance programs in place to ensure all properties in the complex are maintained to the same high standards.

So, the strong and compelling case for Brisbane continues, and mark my words, as soon as the mainstream media in Sydney and Melbourne pick up on the incredible value and opportunity that exists in our major northern city, people will flock up there, and Brisbane will see similar to growth to its southern neighbours.

The time to jump on Brisbane is now. We are in the market every day and have been placing clients in to this sleeping giants for 2 years.If you would like to be matched to premium property that is relevant and appropriate to your individual circumstances then get in touch. We are here to serve you and will be here throughout the journey from start to finish, and beyond….